-

Common Real Estate Terms Every Homebuyer Should Know

If you’re buying a home for the first time, you might get confused with some of the widely-used real estate terms. Your realtor may use these terms frequently, believing that you’re familiar with the jargon, and you could just sit and think, “what’s he talking about?”

Here, I have outlined 10 of the most common real estate terms used in the city. Knowing them would help you a ton when you head out to buy your very first house.

Real Estate Terms Every Homebuyer Should Know

Common Property Types

Bungalows

Bungalows (derived from the Bengali word: “bungala”) are yet another popular type of house in the country.

“A bungalow is usually a single-story house.”

That is the simplest definition of a bungalow. Whereas, in reality, bungalows are pretty much more than that. They’re usually found away from downtown areas, have large open spaces with less covered areas, and usually have a cabana.

Some homebuyers believe that these are prominently built for the elderly. But it isn’t true. These houses are quite popular among the masses and even gained popularity after the coronavirus outbreak.

Lately, these houses, including detached and semi-detached houses, have become so popular that they are short in the market. The best way to find the right house is to search with terms like ‘bungalows for sale in Toronto.’ With such keywords, the chances are high that you will find your dream house.

Condominiums

The alternate word for “apartments” is “Condominiums” (condos for short) and is widely used in the USA and Canada.

“Condos are units located in complexes similar to apartments.

Condos are administered by condominium associations.

Condos have been popular among the masses. Compared to single-family homes, they’re relatively inexpensive and suitable for bachelors, couples, and immigrants.

However, they have several disadvantages, including a shared lobby, elevator/staircase, and building entrance. Not only this, residents of a condo require permission from the building authority to remodel their dwellings’ insides.

Ever since the coronavirus outbreak, people had been avoiding living or acquiring these small, affordable houses. But this trend is changing for two of several reasons: (a) low-interest rates in the country and (b) spread of vaccination.

With this news, the market of condos has seen a slight hike. For instance, back in February 2021, the number of condos sold in the GTA jumped by 64% year-over-year, leading to a rise in condo prices.

Buyers wanting to acquire condos in Toronto may head towards the condos for sale in Toronto listings.

Detached and Semi-detached Houses

When it comes to single-family homes, the most common ones are detached and semi-detached houses. Both types are relatively bigger, more expensive, and in high demand.

In February 2021, the Canadian housing market witnessed another hike in prices when detached houses observed a price hike of 23%. In contrast, semi-detached houses saw a hike of 20% on a year-over-year basis.

In definition, a detached house is:

“A freestanding house, not sharing a common wall between two houses.”

Whereas a semi-detached house is a

“A house shares a common wall on one side and is actually built as one part of two houses.”

Financial Terms

Mortgage Pre-Approval

Most homebuyers prefer buying a house with a mortgage. While ‘mortgage’ is a common term and everyone knows it, the term “mortgage pre-approval” is not known to many.

“A mortgage pre-approval is a letter your lender provides stating that you’re eligible for a specific amount based on the information you’ve provided. The lender takes the decision based on your income, credit score, and assets.”

Note that getting a mortgage pre-approval isn’t a guarantee that you’ll get the mortgage. The expiration period of this letter is 90 to 120 days.

Fixed-Rate Mortgages

When applying for a mortgage, you usually have three options; one of them is a fixed-rate mortgage.

“As the name suggests, a fixed-rate mortgage is when the rate remains the same for the entire mortgage term.”

A fixed-rate mortgage is feasible if rates are expected to increase soon. So, if the current mortgage rate is 2.1% and you suspect it will increase, it’s better to apply for a fixed-rate mortgage so that you could save a little over the period.

Variable-rate Mortgage

This type of mortgage is different than the earlier one.

“A variable-rate mortgage is when the rate doesn’t remain fixed over the mortgage term.”

The mortgage rate could move in either a favourable or adverse direction.

Other Related Terms

Home Inspections

While you are acquiring a new home, you may have to hire a home inspection company. Home inspection companies will help buyers identify if the property needs remodelling or repairs? They’ll deeply look into the house and help you determine if the deal is worth it or not.

If the inspecting company finds any problem, you could ask the seller to fix the problem or reduce the price, or you could walk away from the deal.

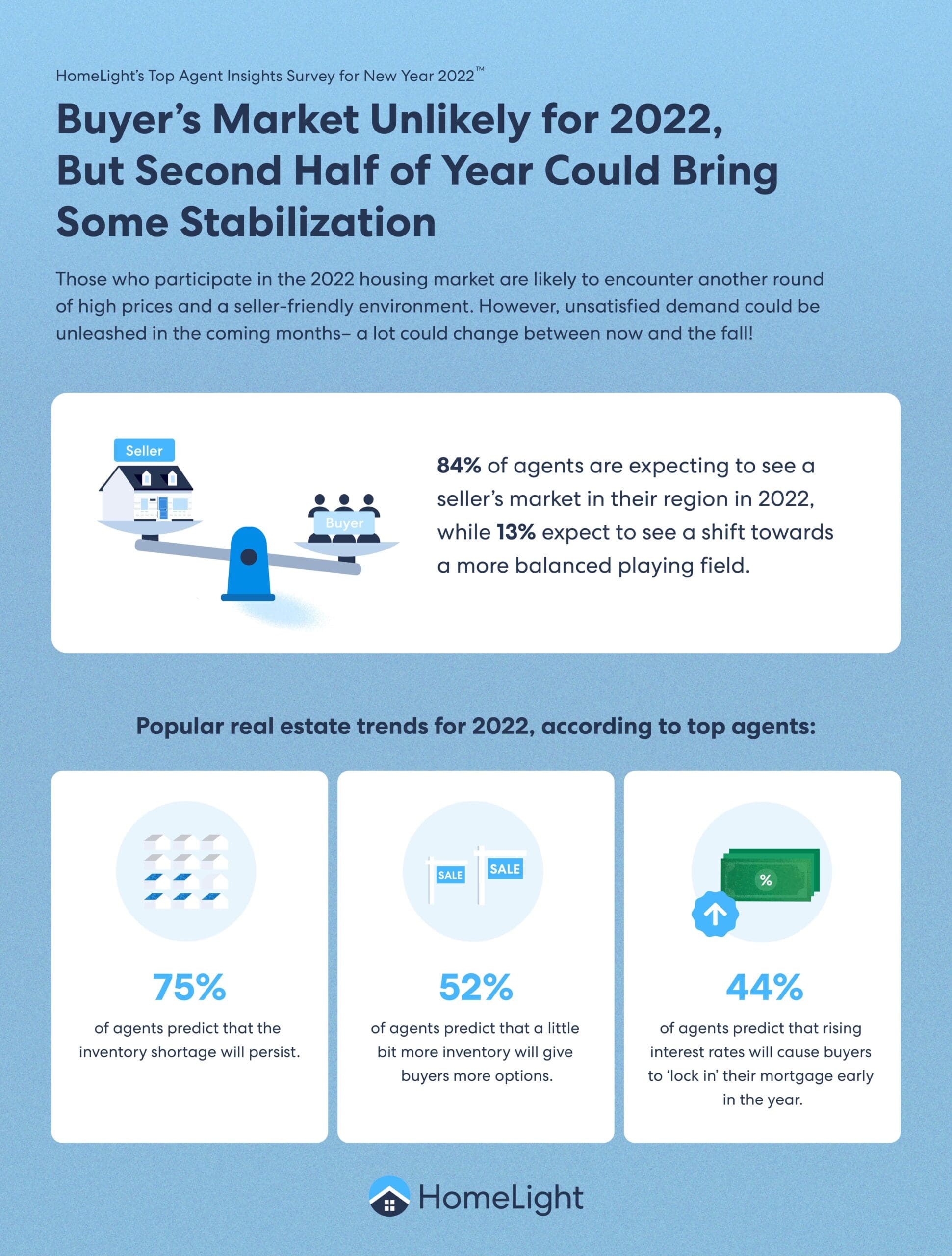

Buyer’s Market

When there are more sellers (or houses) in the market than buyers, it’s called the buyer’s market.

In a buyer’s market, home prices are relatively favorable to buyers since they have multiple options. If they don’t like an offer from a seller, they could easily walk away and buy another property.

Seller’s Market

That’s as opposed to the buyer’s market. When there are more buyers than available sellers (or houses), it is the seller’s market.

In a seller’s market, home prices are relatively higher as sellers take advantage of low inventory. Ever since the COVID-19 outbreak, it has been a seller’s market in Canada.

Single-family homes are relatively in the seller’s market, whereas condos are in the buyer’s market.

Final Thoughts

These are just a few real estate terms that are widely used among realtors. Hold on to these and others, and you’ll feel much stronger when heading towards selling or buying a home.

Provided by 9 Reasons Buying a House Will Be 100% Worth It